How to Save $1 Million(ish) as Fast as Possible

By Grant Lancaster on Thursday, March 31, 2022

While the advice is as simple as "save your money," we know it's not that easy. The following tips, tricks and tools are here to help you start now, so you can enjoy the spoils of your financially responsible habits as an adult!

Every major stage of your life, whether it’s buying a car, signing a lease or starting your own business, is going to require money. Money can be a barrier, but also a tool, if you use it right, and the most fundamental concept behind making money work for you is saving.

But how do you save hundreds or thousands if you’re not making much? Long-term goals are daunting, but you have to start saving early and know the tricks to building wealth.

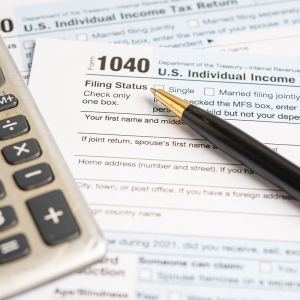

The Basics

Start with a bank account. Get a checking account and at least one linked savings account so you can move money between accounts. A checking account lets you get paychecks through direct deposit and spend with a debit card.

Some banks even offer benefits to teens setting up bank accounts. For example, Simmons Bank offers a Save10 Youth Savings Account for people under 17, and will match your first $10 saved, give you small bonuses for making A’s in school and even pay you $100 when you turn 18.

You won’t earn much interest on these accounts, but the point is to have your first tool for saving.

Emergency Funds

Before you confront long-term goals or fun purchases, you need money stashed in case something bad happens—an injury, a job loss or another unexpected expense. That’s your emergency fund.

Try to save enough to cover three to six months of expenses; a couple thousand dollars would get you out of a tight spot. Budget money from each paycheck to the fund, and don’t forget to refill it when you spend some.

Financial adviser Sarah Catherine Gutierrez, founder and CEO of Aptus Financial, thinks the biggest pitfall people encounter with an emergency fund is spending it on non-emergencies. Create a separate savings account for non-emergencies—for your long-term goals, travel and fun purchases.

“If I had spent my (emergency fund) like that, I never would have started my business,” Gutierrez said.

Saving Tactics That Really Work

“Society teaches us to spend first and save what’s leftover,” Gutierrez said. “That’s a recipe for disaster.”

You should do the opposite, saving first and spending what you have left. Some people call this paying yourself first, because you save money before paying for anything else.

Gutierrez outlined a four-step money management plan you can apply to your paychecks:

1. Pay long-term expenses: “Pay” into your savings account and/or retirement fund, and pay off credit card or student loan debt. You don’t have to pay it all off at once, but dedicate a certain percent of your paycheck to tackling those expenses.

2. Pay short-term expenses: If you used money from your emergency fund or you’re saving to make a car payment, take a portion of your income and put it toward those costs.

3. Pay bills and monthly expenses: check out How to Create a Budget for a list of what these might be.

4. Spend the rest: After saving and paying your bills, anything left is yours to spend! It might seem like this is where you get paid, but remember that this money goes to other people - restaurants, hairdressers, shoe stores. If you end up with a lot of money here, consider upping your savings or debt payments.

You may need to adjust your savings based on your living expenses, but it’s important to save something and to make it a priority.

Make Saving Easy

With online shopping and apps like PayPal and Venmo, it’s extremely convenient to spend money. Your goal is to make a system that makes it convenient to save money, Gutierrez said.

Michelle Rogers, market retail manager for Simmons Bank’s Central Arkansas Market, suggests that young adults look into automated savings and rewards programs at their banks to make saving easy.

One way to pinch pennies is automated round-up saving for checking accounts, meaning that if you spend $4.25 on a coffee, banks like Simmons will automatically round the purchase up to $5, putting the extra 75 cents in your savings. This won’t seem like much, but 50 cents here and there adds up.

If your bank doesn’t offer a similar service, apps like Acorns can do the same thing, giving you the flexibility to adjust the amount it saves automatically.

Another way to save, is to get your money to grow itself. Lauren Steel is the Principal of The Firmament Group, a private equity firm, which helps small businesses grow.

“The most important advice that I would give to someone looking to build wealth, which is the advice given to me years ago, is to be an owner,” says Lauren. “Own equity in your business. Own your house, own your car and invest. Your salary, even for top tier earners, will never compare to the wealth you can build through ownership of good businesses over time. Secondly, be a generous person. Give of yourself, your time and your money for causes that don’t directly benefit you.”

Retirement

You might have been surprised that Gutierrez listed retirement as the first saving goal, especially at your age. It just doesn’t seem like a priority, especially if money is tight!

But making a habit of saving now and setting up a retirement account at your first serious job is super important. Gutierrez recommends that you save 10% of every paycheck for retirement.

Saving money now isn’t just delaying gratification until you’re older, Gutierrez said, it’s making it easier on yourself a few years down the road. If you save 10% now, you won’t have to save 15% to catch up to your goals when you’re in your 30s. You’re saving yourself money down the road.

For retirement savings, you’ll hear about Roth IRAs and 401(k)s. An IRA is an individual retirement account, something you manage yourself through another company, whereas a 401(k) is an employer-sponsored retirement plan.

You should try to join your company’s retirement plan if they have one, Gutierrez said. If they don’t, or they require employees to work for a certain time before joining, you should look into an IRA. With 401(k)s, you can arrange for a certain percentage of your paycheck to be automatically placed in your retirement savings—it’s that easy. With an IRA, you can do the same thing, but you’ll have to set it up through a financial company.

Don’t be intimidated! Gutierrez said that’s the biggest barrier to young adults starting retirement accounts. Rogers thinks that young people often don’t ask enough questions about their banking.

“The younger you start, the easier it is—it becomes a habit,” Rogers said.

Ways to Cut Spending Fast

(so you can save even faster!)

If you’re making a budget and find that the money always seems to run out too soon, consider these tips instead of dipping into your hard-earned savings:

• Plan to only eat out once or twice a month—cooking for yourself is cheaper, can be healthier and it’s a great skill to have.

• Make your own coffee instead of buying from expensive cafes—you can even get coffee beans from your local cafe if you want to support them!

• Cut out any subscription services you don’t use frequently. Amazon Prime’s free shipping isn’t worth it if you never order anything!

• Keep your receipts (or at least check your bank account frequently) so you can see how much you’re spending—that’s not just an imaginary number!

• If you’re trying to decide on a non-essential purchase, wait 24 hours and see if you still want it as badly as you thought you did.

• Think of purchases in terms of the hours worked, not just the cost. Are those shoes worth 40 hours of work (a week’s pay)?

• Talk with your family before the holidays and set a spending limit on gifts so that you don’t splurge more than you need to—plus, you avoid the awkwardness of someone getting you a gift worth more than what you got them!

• Don’t forget to take preventative health measures like going to the dentist and going to checkups. It costs money on the front end, but it’s a lot cheaper than an emergency root canal or other medical cost.

No matter how you choose to save or how much you can afford to save, remember that any savings is good savings. Don’t let anyone make you think that only saving a little money is bad if that’s all you can afford!